Introduction

Contribution Margin Ratio An important indicator in financial analysis that sheds light on the profitability and effectiveness of a business’s operations is. Fundamentally, the Margin Ratio shows how much of every dollar of sales goes toward paying for fixed expenses and making a profit for the business. Businesses must comprehend this ratio in order to evaluate the financial health of their operations and to make well-informed decisions about cost control, product mix, and pricing. The Margin Ratio provides a clear picture of a company’s capacity to turn a profit and maintain operations over the long term by indicating the percentage of revenue left over after deducting variable costs.

Recognizing Fixed and Variable Costs

A company’s cost structure is primarily composed of fixed and variable costs, which serve as the foundation for determining the Contribution Margin Ratio. Variable costs immediately affect the cost of products sold and, as a result, the contribution margin as they vary in response to shifts in production levels or sales volume. Conversely, fixed costs, which include things like rent, salary, and insurance premiums, don’t change based on production or sales activity. It is imperative to differentiate between these two categories of expenses in order to precisely calculate the contribution margin and evaluate profitability. Deducting variable costs from sales revenue immediately aids in determining the percentage of revenue that may be used to pay for fixed expenses and turn a profit. Effective cost management requires an understanding of how variable and fixed expenses interact.

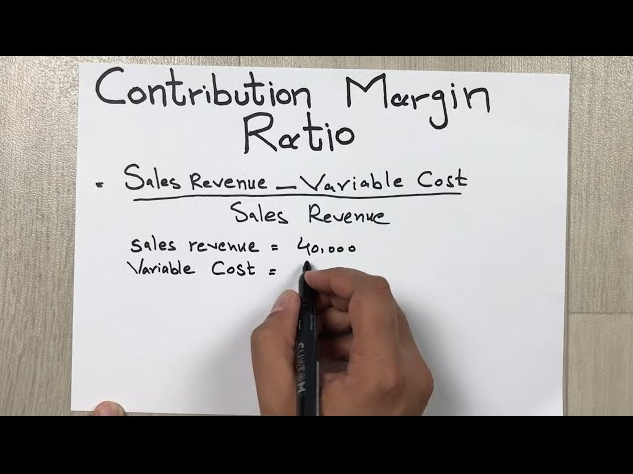

Contribution Margin Ratio Formula: Explained Step by Step

Understanding the Contribution Margin Ratio Formula

- Definition and Purpose: The Contribution Ratio is a financial metric that represents the proportion of sales revenue that contributes to covering variable costs and, subsequently, fixed costs and profits. It provides insights into the operational efficiency and profitability of a business.

- Importance in Financial Analysis: By analyzing the Margin Ratio, businesses can assess their ability to cover fixed costs and generate profit from each unit of sales.

Components of the Contribution Margin Ratio Formula

- Sales Revenue: Total revenue generated from the sale of goods or services.

- Variable Costs: Costs that vary with changes in production or sales volume, such as raw materials, direct labor, and variable overhead.

- Fixed Costs: Costs that remain constant regardless of production or sales activity, including rent, salaries, and insurance.

Step-by-Step Calculation Process

- Step 1: Determine Sales Revenue: Obtain the total revenue generated from sales during a specific period.

- Step 2: Identify Variable Costs: Calculate the total variable costs associated with producing the goods or services sold.

- Step 3: Calculate Contribution Margin: Subtract total variable costs from sales revenue to find the contribution margin.

- Step 4: Calculate Margin Ratio: Divide the contribution margin by sales revenue and multiply by 100 to express it as a percentage.

Interpretation of Contribution Margin Ratio

- Significance of the Ratio: A higher Contribution Ratio indicates that a larger proportion of each sales dollar contributes to covering fixed costs and generating profit.

- Benchmarking and Comparison: Businesses can compare their Margin Ratio with industry benchmarks or historical performance to assess their operational efficiency and profitability.

- Implications for Decision Making: The Contribution Margin Ratio helps businesses make informed decisions regarding pricing strategies, product mix, cost management, and resource allocation.

Real-world Examples and Applications

- Case Studies: Analyzing actual financial data to calculate and interpret Contribution Ratio in different business contexts.

- Practical Scenarios: Demonstrating how businesses utilize the Margin Ratio in day-to-day operations and strategic planning.

- Industry-specific Considerations: Highlighting how the Contribution Margin Ratio may vary across industries and its implications for specific sectors.

Interpreting Contribution Margin Ratio

Significance of the Ratio:

- Indicates the efficiency of covering fixed costs: A higher Margin Ratio suggests that a larger portion of sales revenue is available to cover fixed costs, indicating better operational efficiency.

- Reflects profitability: The Contribution Margin Ratio provides insights into the profitability of each unit sold, as it represents the percentage of sales revenue that contributes to covering fixed costs and generating profit.

Benchmarking and Comparison:

- Industry benchmarks: Comparing the Contribution Margin Ratio with industry averages or benchmarks helps businesses evaluate their performance relative to competitors and industry standards.

- Historical comparison: Analyzing trends in the Contribution Margin Ratio over time allows businesses to assess improvements or declines in operational efficiency and profitability.

Implications for Decision Making:

- Pricing strategies: Businesses can adjust pricing strategies based on the Margin Ratio to ensure profitability while remaining competitive in the market.

- Product mix decisions: Evaluating the Contribution Margin Ratio for different products or services helps businesses prioritize offerings that contribute most to overall profitability.

- Cost management: Identifying areas where the Contribution Ratio can be improved guides cost-cutting measures and resource allocation decisions.

Limitations and Considerations:

- Does not account for overhead costs: The Contribution Margin Ratio focuses on variable and fixed costs but does not consider overhead expenses, which may impact overall profitability.

- Assumes linear cost behavior: The Contribution Ratio assumes that costs behave linearly, which may not always hold true in real-world scenarios with nonlinear cost structures.

- Contextual interpretation: Interpreting the Contribution Margin Ratio requires consideration of the specific context and industry dynamics, as what constitutes a favorable ratio may vary across different businesses and sectors.

Step-by-Step Guide to Contribution Margin Calculation

Calculate Revenue from Sales:

Determine the total amount of money received during a certain time frame from the sale of products or services.

Determine Variable Expenses:

Compute the entire amount of variable expenses related to manufacturing the products or rendered services, encompassing raw materials, direct labor, and variable overhead.

Deduct Variable Costs from Revenue from Sales:

To find the contribution margin, deduct the whole amount of variable costs from the sales revenue.

Determine the Ratio of Contribution Margin:

- The contribution margin is divided by the sales income.

- To convert the value to a percentage, multiply it by 100.

Analyze the outcomes:

- To determine how much of sales revenue is available to pay fixed costs and make a profit, analyze the margin ratio.

- Greater operational efficiency and profitability are indicated by higher ratios, while ower ratios may signal potential areas for improvement.

Leaving Out Fixed Costs:

To isolate the variable contribution of each unit sold, fixed costs must be subtracted from the contribution margin calculation. Fixed costs are not directly impacted by the quantity of units produced; they stay the same regardless of variations in production or sales volume. Businesses are able to concentrate exclusively on the share of sales income that goes toward covering variable costs and turning a profit by eliminating fixed costs. In order to improve overall profitability and efficiency, this makes it possible to make better decisions about pricing strategies, product mix optimization, and resource allocation. It also makes it easier to grasp the incremental profitability of each unit sold.

Analyzing Profitability

Analyzing profitability with the Contribution Ratio reveals important details about a company’s productivity and financial health. This ratio illustrates the percentage of sales revenue allocated to operating a profit and covering fixed costs. A higher contribution margin ratio suggests more profitability because more sales revenue is available to cover fixed costs and turn a profit. By tracking changes in the Margin Ratio over time, businesses can identify areas for optimization and assess gains or losses in profitability. This study enables informed decision-making on pricing strategies, cost-cutting tactics, and resource allocation to maximize profitability and long-term growth.

Using Contribution Margin Ratio in Decision Making

Pricing Strategy Optimization:

- Leveraging Margin Ratio to set optimal pricing levels that ensure profitability while remaining competitive in the market.

- Adjusting prices based on variations in variable costs or changes in market demand to maintain desired Contribution Margin Ratios.

Product Mix Analysis:

- Evaluating the profitability of different products or services by comparing their Contribution Margin Ratios.

- Allocating resources and marketing efforts to products with higher Contribution Margin Ratios to maximize overall profitability.

Cost Management Initiatives:

- Identifying opportunities to reduce variable costs to improve the Contribution Margin Ratio without compromising product quality or customer satisfaction.

- Implementing cost-saving measures targeted at minimizing fixed costs to increase the portion of sales revenue available for covering variable costs and generating profit.

Resource Allocation Optimization:

- Allocating resources, such as labor and capital, to activities or projects with the highest potential to increase the Margin Ratio.

- Prioritizing investments in initiatives that enhance operational efficiency and drive revenue growth while maintaining or improving profitabilit

The Contribution Margin Ratio Is Important for Making Decisions

Optimization of Pricing Strategies:

- price levels that are both profitable and competitive by using the Contribution Ratio.

- modifying pricing in response to shifts in variable costs in order to preserve intended profit margins.

Analysis of the Product Mix:

- analyzing the contribution margin ratios of various goods and services to determine how profitable they are.

- To increase total profitability, resources should be directed toward items with larger Contribution Margin Ratios.

Initiatives for Cost Management:

- Finding ways to lower variable costs in order to raise the contribution margin ratio.

- putting cost-cutting strategies into practice with the goal of lowering fixed expenses and raising profit margins.

Optimization of Resource Allocation:

- directing funds toward initiatives or tasks that have the best chance of raising the margin ratio.

- putting funds toward projects that improve profitability and operational efficiency first.

In summary

Businesses benefit from the Contribution Margin Ratio, crucial for profitability insights and operational efficiency. It aids pricing, cost management, product optimization, and resource allocation decisions. This ratio enables strategic planning for profitability and growth by showing the revenue portion for fixed costs and profit. It facilitates comparisons with past performance and industry standards for monitoring progress and identifying areas for improvement. Integrating it into decision-making fosters increased financial success and competitiveness in industries.

FAQs

Q: What is the Contribution Margin Ratio?

The Contribution Margin Ratio is the percentage of sales revenue covering fixed costs after subtracting variable costs.

Q: How is the Contribution Margin Ratio calculated?

The Margin Ratio is calculated by dividing the contribution margin by sales revenue, then multiplying by 100.

Q: Why is the Contribution Margin Ratio important?

A: It provides insights into operational efficiency and profitability, aiding decision-making in pricing, product mix, cost management, and resource allocation.

Q: What does a higher Contribution Margin Ratio indicate?

A higher Margin Ratio indicates greater operational efficiency and profitability. It suggests that more revenue is available to cover fixed costs and contribute to profit.

Q: How can businesses use the Contribution Margin Ratio?

A: Businesses utilize it to optimize pricing, analyze product profitability, manage costs, allocate resources, and benchmark performance.